The Current Opportunity

Today’s energy ecosystem offers a unique opportunity for independent oil & gas producers

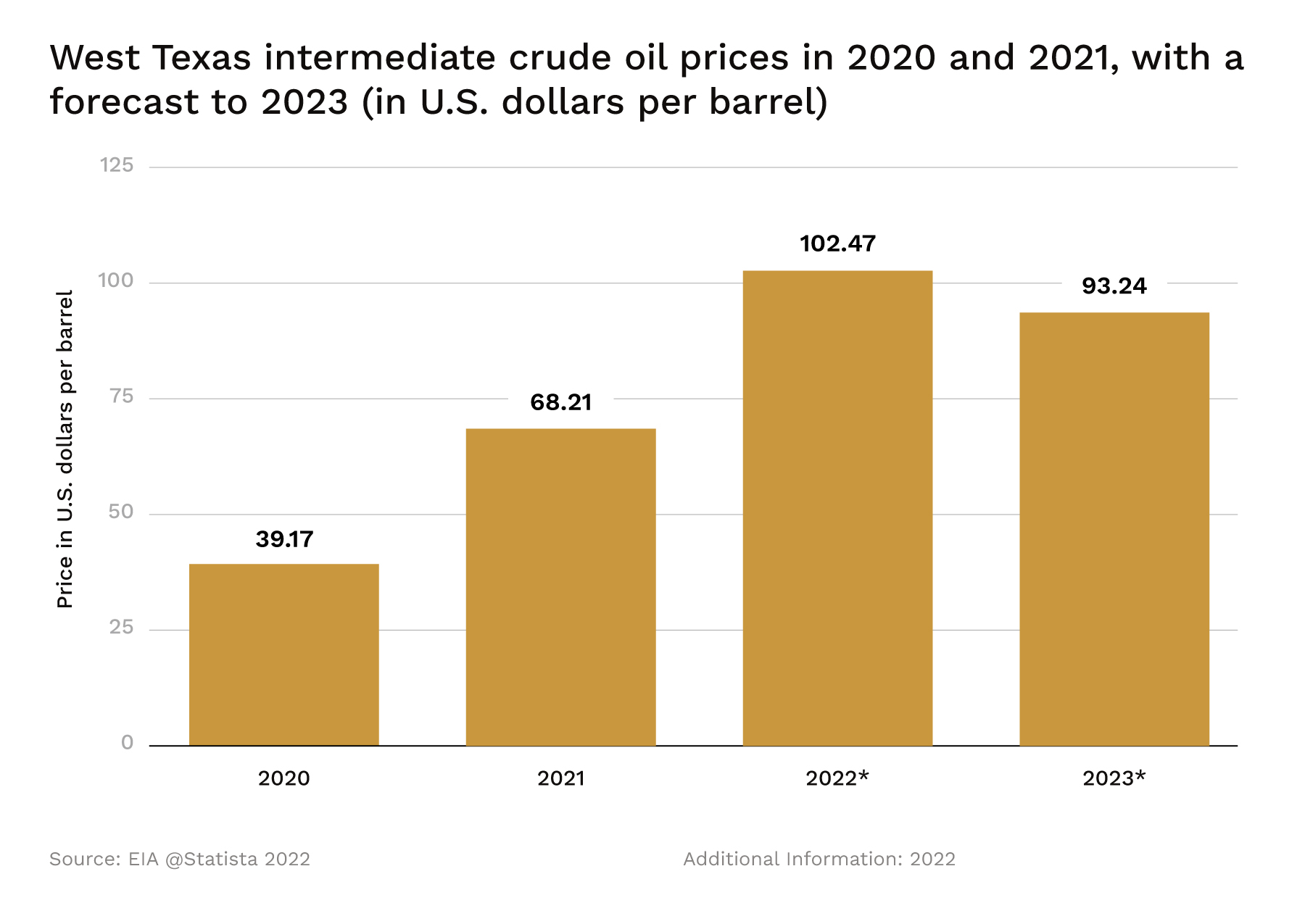

Timing is one of the most critical factors that determines the overall financial performance of an oil and gas investment strategy. Having a firm understanding of geopolitical and governmental pressures, geological and engineering characteristics, as well as insights into the impact of monetary policy and other macro economic factors, is crucial in understanding commodity price cycles and what drives them.

“As we approach 2022, it is increasingly clear that next year — and potentially the next five — in the oil and gas industry will be defined by capital markets’ reluctance to invest in oil and gas and the dissonance among government, consumer and investor perceptions about the speed with which oil and gas should or can be replaced and the very real inertias that will slow that transition.”

Reference: Ernst & Young 12/2021 Report

When analyzing comprehensive global datasets of oil and natural gas markets, the data suggests the next five to eight year window offers smaller independent producers and individual oil and gas investors one of the most attractive environments to deploy capital in the history of energy investing. Why…?

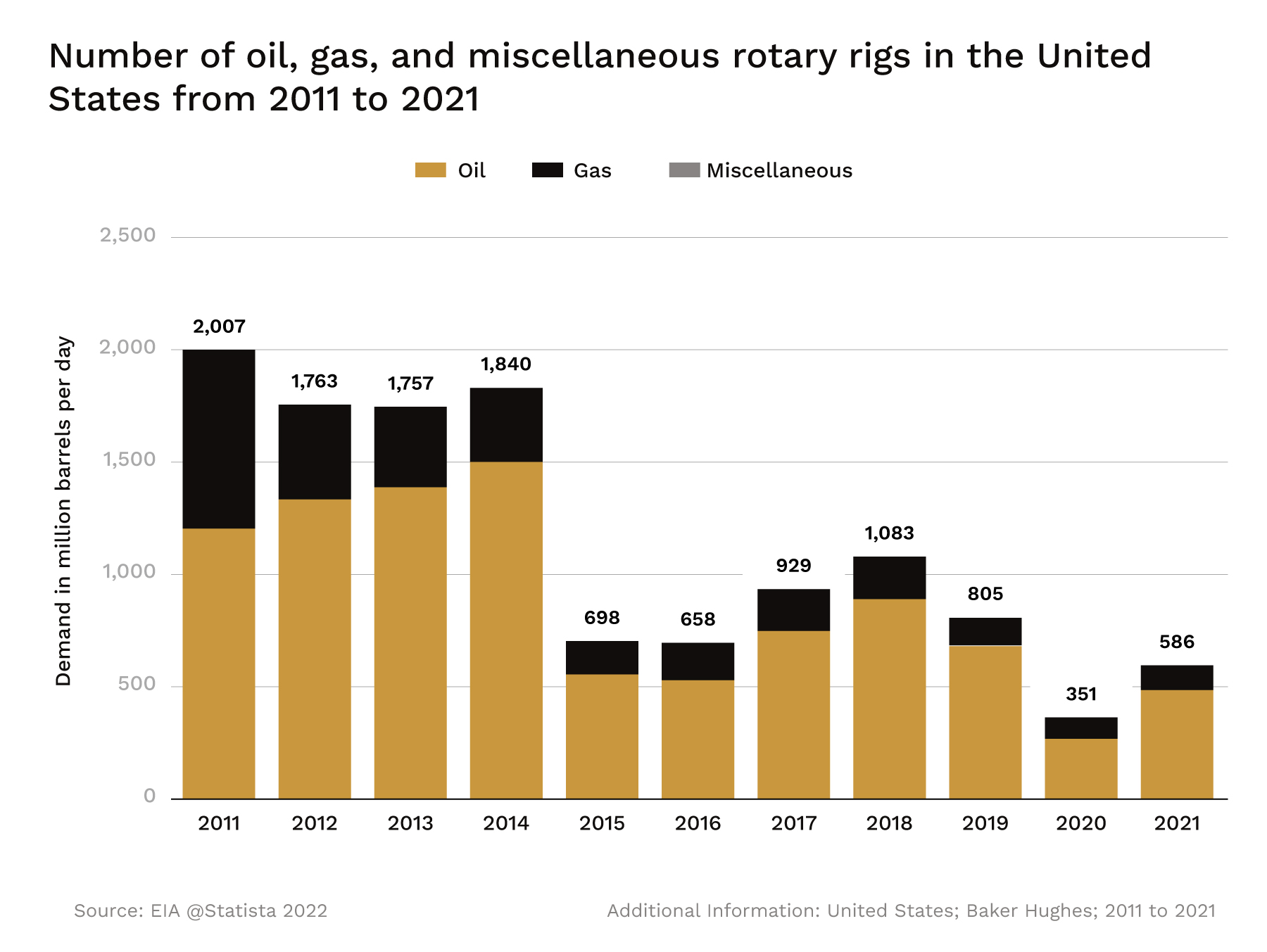

Under Investment in Exploration

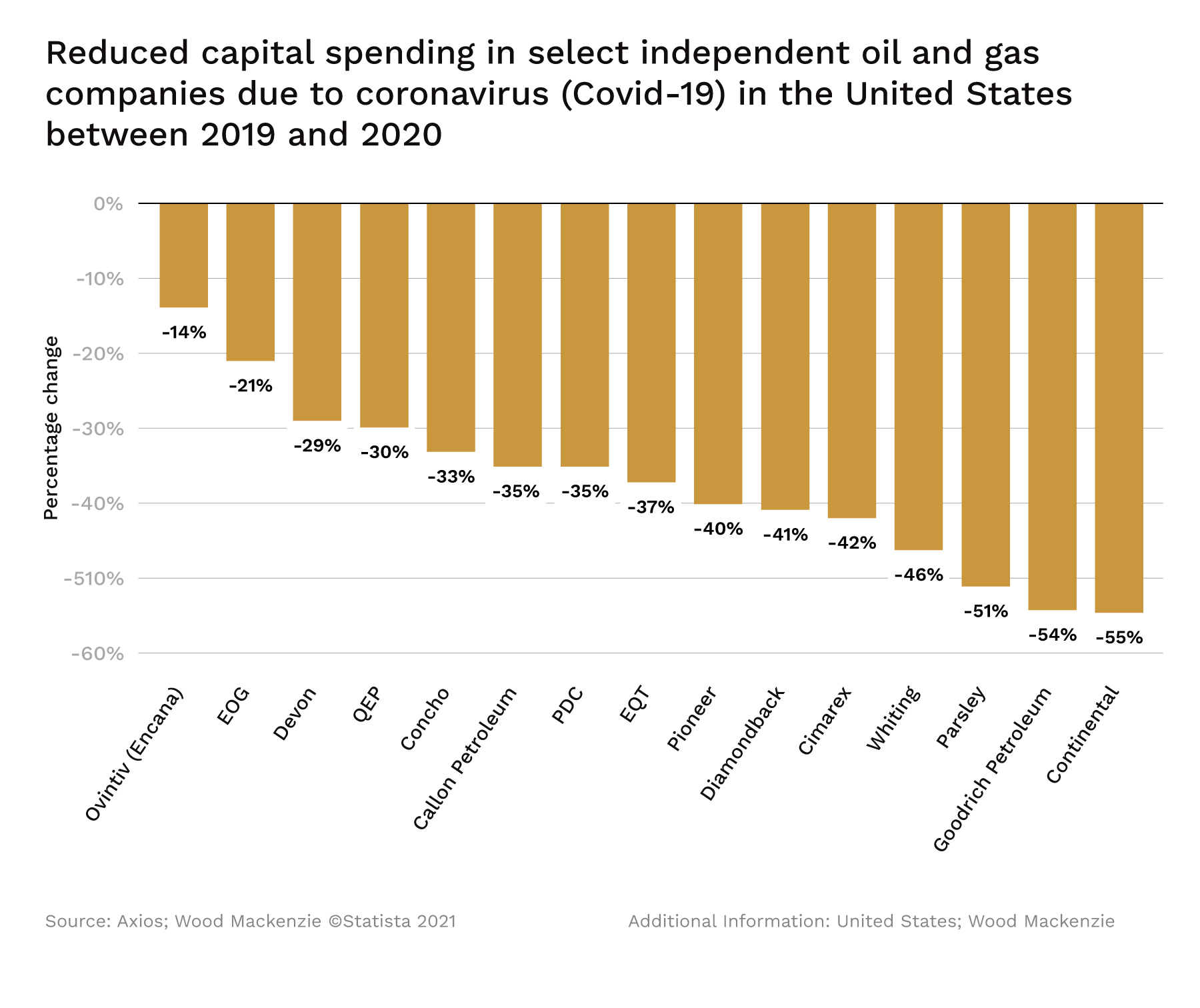

Covid-19 induced supply cuts combined with energy transition pressures that environmentalist groups, activist investors, and governments have put on the major energy ecosystem have resulted in significant underinvestment in exploration. The resulting decline in spare global oil capacity elasticity will take quite a while to reverse, if it ever does, setting the stage for a probable oil price supercycle.

Key Factors & Market Indicators

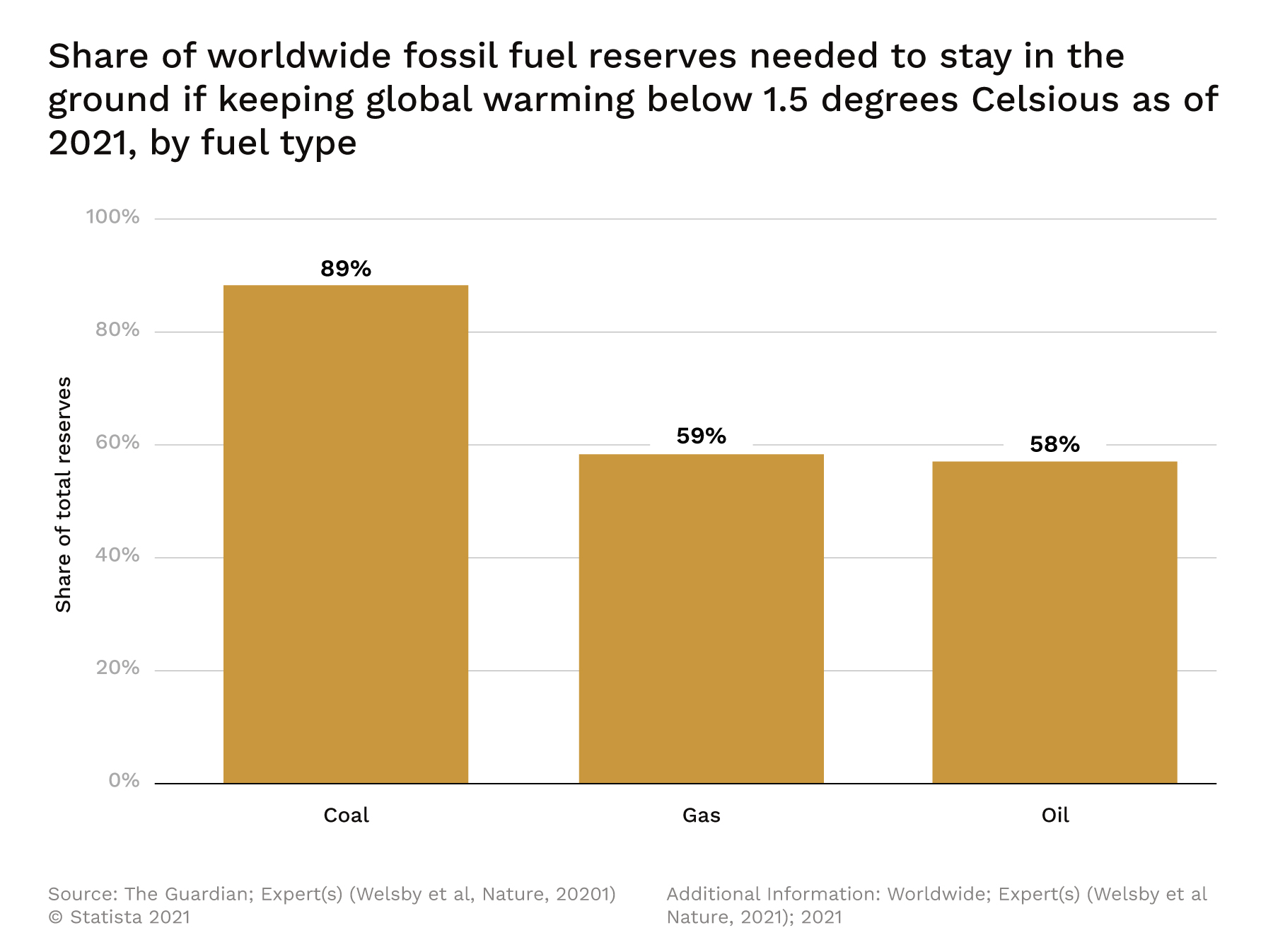

“Big Oil” Stranded Asset Risk

Analysts forecasts suggest that if “Big Oil” continues to explore for oil & gas, it may end up with some $500B to $1T in stranded assets- further complicating 5-7 year global supply/demand outlooks.

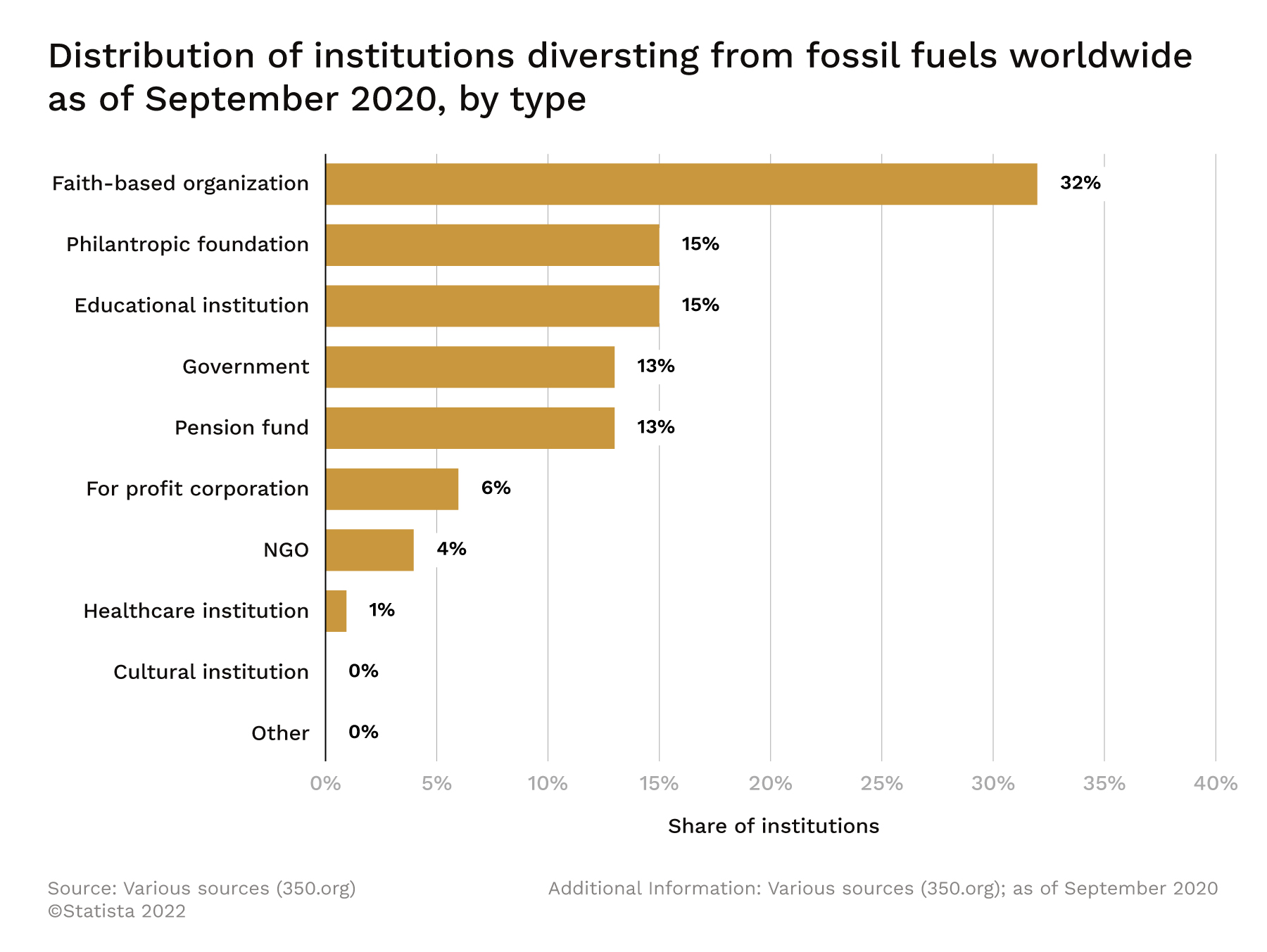

ESG Pressures

ESG (environmental, social and governance) mandates on pension fund managers, sovereign wealth fund managers, and other institutional investors are on the rise. “The Great Energy Shift” by institutional investors, out of fossil fuels and into renewables, is now well underway and will not be quickly reversed.

Oil & Gas Demand Growth

The IEA’s future demand outlook for oil continues to grow with global demand predicted to surpass 100 million bbls per day in 2022 for the first time in history. If this scenario holds, and supply constraints remain in place, the world faces a structurally undersupplied market going forward.

Rise of the Independents

As big oil corporations continue to divest assets, and as oil & gas focused private equity managers and their institutional capital providers shift capital allocations away from carbon based fuels- this change of institutional strategy presents an unprecedented opportunity for small, but well equipped independents to acquire top tier oil & gas assets that they otherwise wouldn’t have the opportunity to compete for.

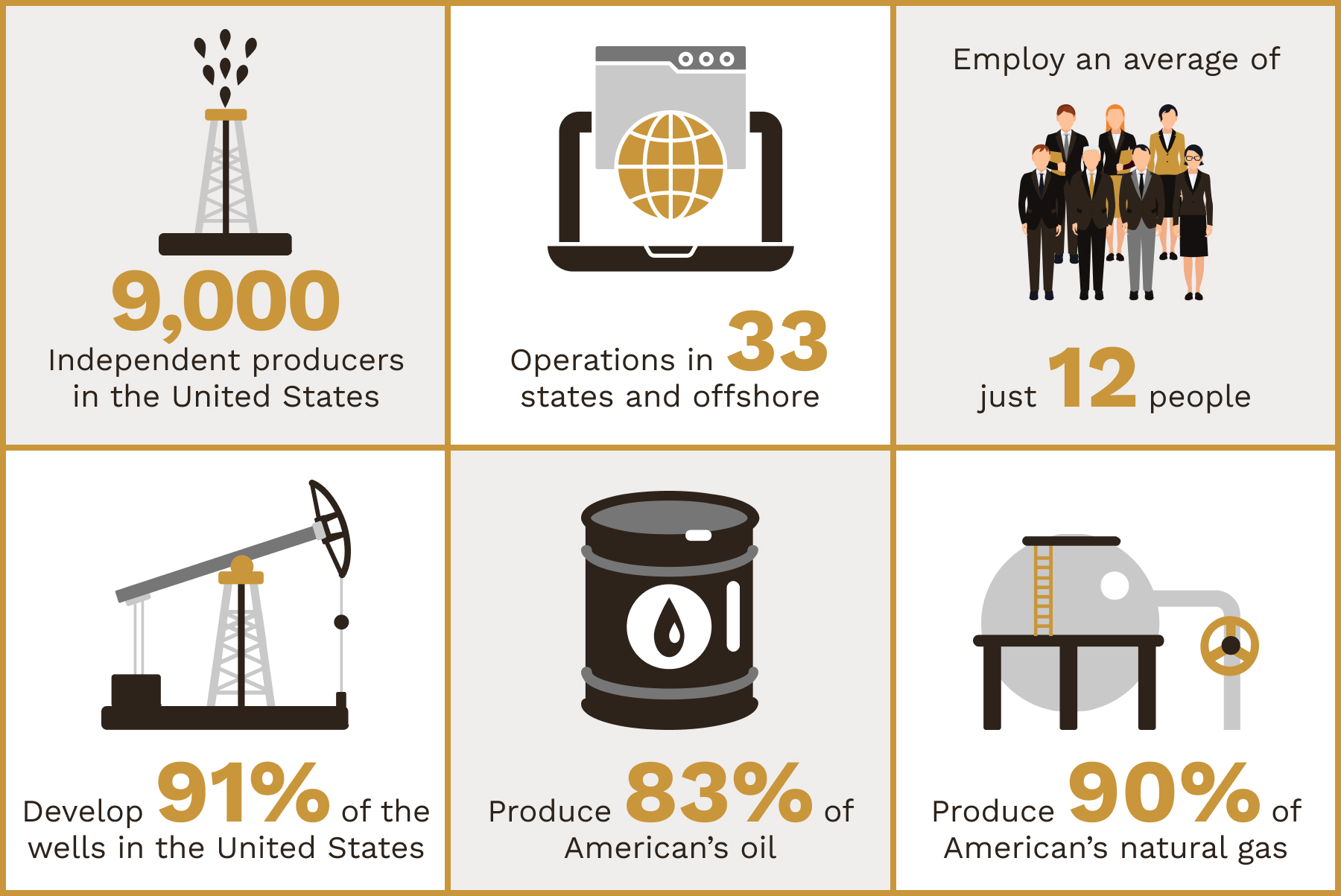

The U.S. Internal Revenue Code section 613A(d) defines an independent producer as a producer who does not have more than $5 million in retail sales of oil and gas in a year or who does not refine more than an average of 75,000 barrels per day of crude oil during a given year.

Independents can be small family companies or publicly traded companies. These companies’ efforts account for 3% of the United States’ Gross Domestic Product and they reinvest billions of dollars back into the American economy to discover and to produce more energy in the most cost-efficient ways.

Independent by the Numbers

Easy to Join. No Better Time to Invest. Let's Produce.

Register a user account on the Tunnel Investment Platform

BROWSE CURRENT OFFERINGS, SET UP YOUR ACCOUNT, & INVEST WHEN READY

TRACK THE PROGRESS AND PERFORMANCE OF YOUR INVESTMENT ON THE PLATFORM

Enter the Tunnel. Start Drilling Now.

Offerings available only to accredited investors.

According to SEC regulations, an accredited investor is someone with a net worth exceeding $1 million (excluding the value of the person’s residence) or someone who has earned an income of $200,000 (or $300,000 for a married couple) in each of the prior two years, someone who holds a Series 7, 65 or 82 license.